Switching banks used to be a laborious ordeal, but today it can be done quickly and easily. It also doesn’t take much to convince a customer to switch—36% of consumers say the primary reason they think about switching banks is simply poor service.[1]

To maintain customer loyalty, banks must ensure they’re providing high quality customer service. Three key strategies offer banks an effective solution: (1) empower employees with predictive intelligence and a single source of truth, (2) enable customers to use self-service tools, and (3) personalize and standardize service delivery across all channels.

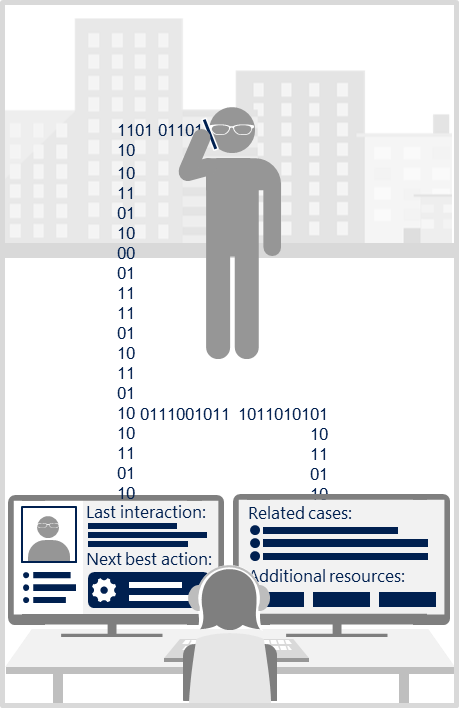

Empower employees with predictive intelligence

Having a single source of truth for customer information is the foundation to providing appropriate and effective support. New technology has made this information even more accessible. Using dynamic role-driven dashboards, agents are now equipped with resources such as contextual tools, guidance, and data that surface the appropriate next steps to deliver the best possible customer experience.

To generate even more value, banks can leverage predictive intelligence to surface critical insights by identifying key patterns in customer data. These insights enable agents to make proactive recommendations tailored to customer needs and life-styles, giving them personalized experiences. On top of this, agents can accelerate time to issue resolution, not only satisfying the customer, but increasing productivity.

Imagine a scenario where a customer is awaiting a recently approved credit card in the mail, but it’s past the expected arrival date. Frustrated, they call the first contact number they find, which happens to take them to a relationship manager instead of customer service. Instead of transferring the call, the relationship manager can instantly bring up the customer’s profile to understand their situation and work to resolve the issue. In this case, the relationship manager cancels the expected card and overnights a new one via courier for secure delivery. In more complex cases, employees can consult a unified knowledge base for guidance. Predictive intelligence surfaces relevant knowledge articles for reference and, based on analysis of successfully resolved cases similar to the current one, can recommend the next best action. With this knowledge, virtually any employee can easily assist customers, avoiding further frustration and ensuring service quality expectations are met.

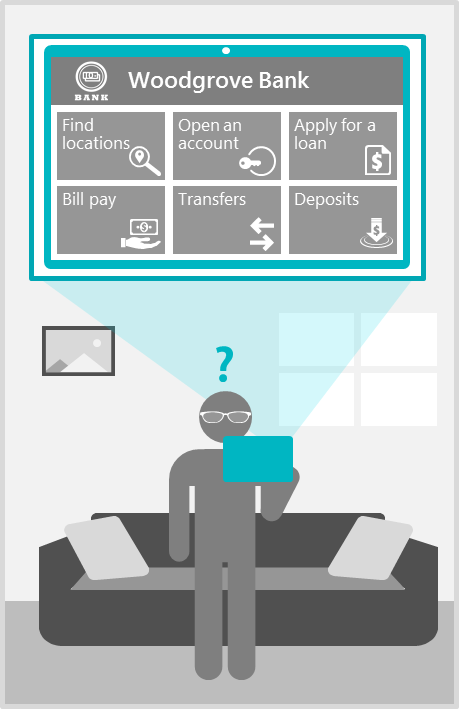

Improve customer satisfaction with self-service tools

Self-service tools are increasingly crucial in today’s digital world. 90% of consumers expect self-service options, as it enables them to find answers faster with more efficiency and control.[2] With capabilities such as searchable knowledge bases, peer-to-peer support, and direct access to subject matter experts, banks can give customers the service they are looking for. At the same time, self-service options free up resources, reduce costs, and increase employee efficiency.

For example, a Thai bank was struggling with dissatisfied customers due to its aging and unreliable contact center platform. Upgrading to a single solution with added self-service features improved their customer service performance. Customers could now find their own answers and avoid queues to speak with agents, ultimately improving overall satisfaction. On top of this, agents could now take 20-30% more calls a day, driving up the efficiency of fielding customer calls.

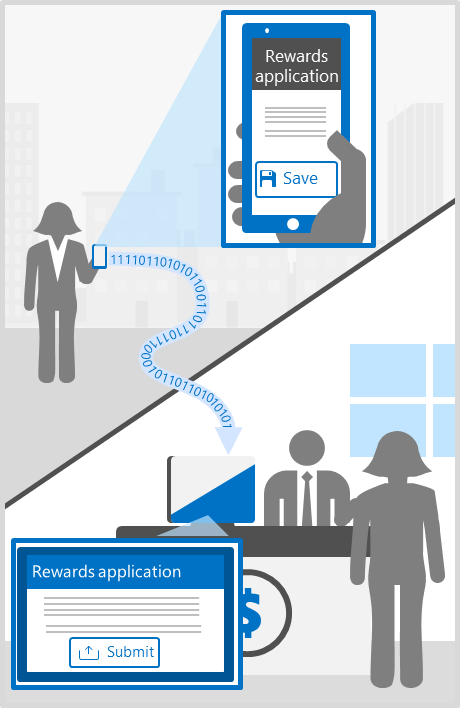

Deliver seamless services across all channels

The importance of leveraging multiple channels to connect with customers is well known. With mobile devices to deposit checks, online portals to manage accounts, and physical branches for in-person assistance, multi-channel support is essential to customer loyalty. In fact, offering multi-channel support can improve customer satisfaction up to 36%.[3]

However, in today’s fast-paced digital landscape something more is needed—an omni-channel approach. With this approach, banks can move from simply supporting customers across multiple channels to creating an effortless end-to-end experience, delivering the same capabilities no matter how customers connect. Unifying data entities and business logic across all channels enables seamless channel switching and real-time awareness.

Imagine a customer’s experience when they begin a rewards program application on their mobile banking app. Later, while visiting their local branch, the agent assisting them sees they’ve left the application incomplete and offers to help them finish it. All the customer’s information has been saved and the agent can begin right where they left off, without re-entering any information. This seamless experience delivers personalized, efficient service with minimal customer effort.

Maximize customer service with the right strategies

Digital technology may be raising customer expectations, but it can also help banks satisfy those expectations and enhance their customer service. Banks can improve service outcomes with real-time intelligence, increase efficiency with self-service capabilities, and deliver a seamless experience with an omni-channel approach, ultimately differentiating them from competitors and increasing customer loyalty.

Microsoft Dynamics 365 enables banks to deliver intelligent, effortless customer service to naturally support the needs of each customer. Through powerful business applications, banks can empower agents with intuitive access to the right information, earn customer loyalty by delivering experiences on their terms, and stay agile with an adaptive service environment. These solutions enrich every customer interaction so banks can offer optimal service and build long term loyalty.